1. Out-of-network ATM fees

1. Out-of-network ATM feesRacking

up fees by using ATMs that aren't on your bank's network? Switch banks

or open an account at a bank that's more convenient to where you

live/work. "Foreign" ATM fees average about $2.50 per transaction, says

BankRates.com. That's more than $250 per year if you use out-of-system ATMs just twice a week!

2. Bottled water

2. Bottled waterGetting your

recommended daily amount of water exclusively in bottled form can easily

cost more than $1,000 per year, as compared with about 50 cents per

year for just-as-healthy tap water. If your tap water has a chlorine

flavor, try refrigerating it overnight before drinking.

3. Oil changes

3. Oil changesRegularly

changing the oil in your vehicles and staying on top of routine

maintenance are good habits to have, but if you're still changing your

oil every 3,000 miles, you may be wasting money. Newer vehicles often

use synthetic oils that can last 7,500 miles or more. See the website

checkyournumber.org for oil change info for newer model vehicles. It's a pretty slick way to save.

4. Incandescent light bulbs

4. Incandescent light bulbsEven

though they cost more, "compact fluorescent lamps" (CFLs) — those crazy

corkscrewed light bulbs — last about five times longer than

old-fashioned incandescent bulbs and use about 75 percent less

electricity. That could easily add up to a net savings of $10 per bulb

per year. Bright idea!

5. Extended service plans

5. Extended service plansDon't

be a sucker for the sales pitch trying to sell you an extended service

plan or warranty of electronics, appliances and other merchandise.

They're rarely a wise purchase, and typically go unused or forgotten by

the consumer. Most merchandise comes with a manufacturer's warranty

that's sufficient for most defects and repairs.

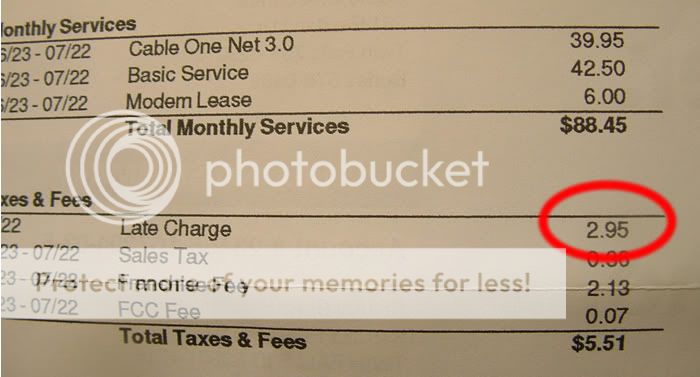

6. Late fees

6. Late feesRecent

consumer protection regulations have helped to limit how much lenders

can penalize you if you're late with a payment, but Americans still pay

more than $20 billion each year in credit card late fees and other

penalties! Put routine monthly bills on an automatic payment plan

through your bank so they're always paid on time.

7. Dry cleaning

7. Dry cleaningCheck

yourself — and your garment tags — if you're constantly running to the

dry cleaners. Few of today's garments really need to be dry cleaned.

Hand washing in cold water and then air drying is preferable for many

apparel items, according to

Consumer Reports. Home dry cleaning kits are another money-saving alternative.

8. Brand-name products

8. Brand-name productsWe're

conditioned by advertising to reach for brand-name products without even

thinking. At least try generic and store brands, starting with the

products you buy most often. You'll typically save 20 percent or more.

9. Aggressive driving

9. Aggressive drivingFast

and aggressive driving is dangerous and can cost you big bucks in terms

of accidents, traffic tickets and increased insurance premiums. But

even if you survive those hazards, aggressive driving — rapid

acceleration, fast cornering and sudden braking — can lower your gas

mileage by as much as a third, not to mention increase wear and tear on

your vehicle.

10. Lottery tickets

10. Lottery ticketsSpeaking of

driving, did you know that if you drive 10 miles to buy a lottery

ticket, statistically speaking you're more likely to be killed in a car

accident than win the jackpot? Why not just stay home and save what you

would otherwise spend on lottery tickets?

~~~~~~~~~~~~~~~~

Request a FREE SAMPLE today. Prilosec OTC® provides 24 hours of zero heartburn with one pill a day.

Click HereYou’d be nuts not to try new FiberPlus Nutty Delights. It’s chocolate, it’s crunch, it’s everything you need! Try it out with a coupon for 70c off. What’re you waiting for?

Get Your Coupon!